Non-operating revenue is income generated episodically from activities that fall outside of your organization’s core business and programs. Non-operating revenue is normally one-time revenue additions such as capital campaign contributions, bequests, gains from the sale of property, or other extraordinary items.

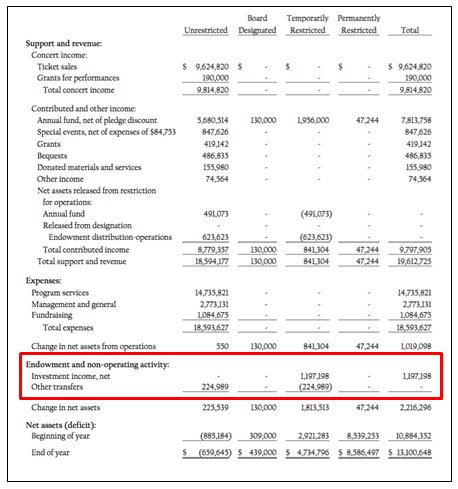

All revenue, including non-operating revenue, is listed on the Income Statement or Statement of Activities. Non-operating revenue may or may not be listed separately from operating revenue and expenses on your audit. You may find non-operating revenue at the bottom of your Statement of Activities below revenue, expenses, and change in net assets. This area may or may not be labeled “Non-operating”.

Because auditors are not required to separate operating from non-operating revenue, if you are not sure which of your revenue items are non-operating revenue on your audit, or whether you have non-operating revenue at all, have a conversation with your auditor to determine if these lines apply to your organization.