Conditional Contributions are different and distinct from Restricted Contributions, and a recent update from the FASB board clarifies how Conditional Contributions are reported in financial statements. The following article will explain the change and how it relates the SMU DataArts CDP survey.

In this article:

- What is a Conditional Contribution?

- What is the update that FASB (Financial Accounting Standards Board) has made about Conditional Contributions?

- How does this FASB update impact your CDP survey data entry?

- What changes might I see in my funder report?

- How can I explain a shift in assets on my funder reports?

- Additional resources

What is a Conditional Contribution?A conditional contribution is one that has a donor-imposed barrier and a right of return back to the donor (this includes a release from the donor's obligation to contribute) if the barrier is not overcome. The agreement or contract between the donor and the organization receiving the contribution will include those 2 attributes in order to be considered "conditional". Conditional contributions differ from donor-restricted contributions in the additional conditions they impose and the possibility that funds may have to be returned if the conditions are not met.

Conditional Contributions are contributions with the following stipulations:

- A donor-imposed barrier to overcome. Examples include:

- An event has to occur (if the event does not, the condition is not met)

- Measurable performance has to be achieved (if performance is not measured or stipulated metrics are not achieved, the condition is not met)

- Qualified expenses have to be incurred (if the organization doesn't incur the expenses, or spends the money on costs that are not allowable under the grant agreement, the condition is not met)

- Specific individuals must be hired (if the hire is not made, the condition is not met)

- A right of return if the barrier is not met (the org has to give back the contribution, of the donor is released from the obligation of contributing.) Examples of situations that might indicate that a contribution is conditional:

- A donor contributes funds to support an event, but stipulates that the funds must be returned if the event is canceled or cannot take place.

- A donor agrees to match donations after the organization raises a specific amount, but stipulates that no contribution will be provided if the organization does not meet the fundraising target.

- A donor requires that an organization submit receipts proving the funds were spent on qualified expenses in order to have contributions disbursed. If the organization does not incur any expenses, the donor is released from the obligation of contributing.

- A foundation gives an organization contribution to cover half of the salary of a newly hired technology officer, but stipulates that the funds must be returned if the organization is unable to find a candidate.

What is the update that FASB (Financial Accounting Standards Board) has made about Conditional Contributions?In June 2018 FASB released an update about conditional contributions. FASB 2018-08 provides clarifying guidance on what contributions are considered conditional and how conditional contributions should be recorded in financial statements. FASB 2018-08 clarifies the following:

- If a contribution is considered "conditional" based on the agreement between the donor and organization, and the org has not yet received the contributions, the organization does not record anything in their financial statements.

- If the contribution is disbursed to the organization prior to the condition(s) being met, the contributions are recorded as a Refundable Grant Advance liability on the organization's balance sheet (not to Donor-Restricted Net Assets or to a revenue account, as with a regular donor-restricted or unrestricted contribution). When the conditions have been met, funds are then debited from this liability account and credited to the corresponding Unrestricted Revenue account.

Recording Conditional Contributions:

- If a conditional pledge is made and you have not received any funds, do not record the pledge as a receivable in your official financial records. (note that some organizations may opt alternative record-keeping mechanisms to track these pledges internally).

- If you HAVE received funds prior to the condition(s) being met, record them as a liability on your balance sheet. The funds are considered a refundable advance until conditions are met.

- Once the conditions have been met, debit the liability account and credit the correct Unrestricted Contribution account.

- If you receive conditional funds after the conditions have been met, record them as an Unrestricted contribution.

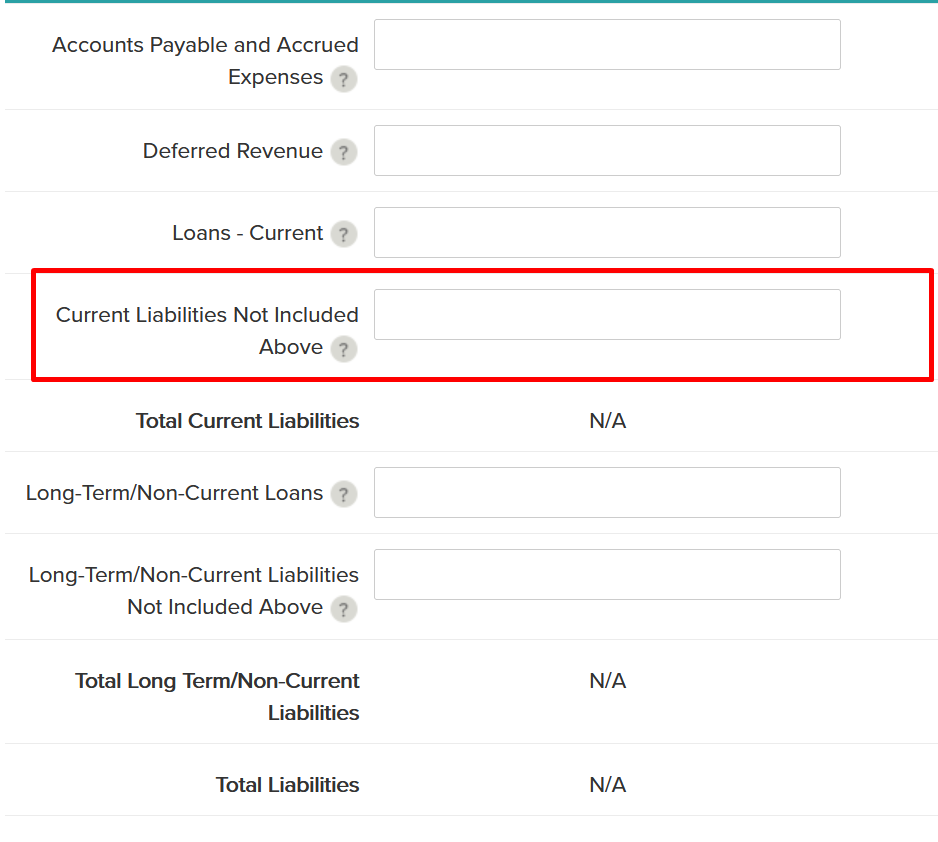

How does this FASB update impact your CDP survey data entry?For audited/reviewed organizations, your auditor is likely to already have made these changes. Please continue to follow your audit to guide your CDP survey data entry as usual. These rule changes may result in a new line in the liabilities section of your Balance Sheet called "Refundable Grant Advances," "Conditional Grant Advances" or something similar. This line item should be entered on the Current Liabilities Not Included Above line of the Balance Sheet section in the CDP. If you have questions about the way conditional contributions have been recorded on your audit or review, please contact your auditor.For organizations without an audit but who have more than $50,000 in expenses annually, we recommend that you follow FASB standards in your bookkeeping and follow your financial statements while entering the CDP. To follow the FASB standards, you will need to know if you have any conditional contributions and record them appropriately in the CDP survey. If you have a conditional contribution pledge and have not received any payments yet, the pledge does not get recorded in the CDP at all and ideally should not be recorded in your organization's Accounts Receivable. If you have a conditional contribution pledge and you

have received funds but have not satisfied the grant conditions, list the amount in the Balance Sheet section of the CDP survey on the Current Liabilities Not Included Above line. You do not need to go back and make changes to any previous surveys.

For organizations with less than $50k in expenses annually, you do not have a CDP Balance Sheet option and would not need to make any accommodations in the CDP survey for conditional contributions, but the changes do apply to your internal bookkeeping.

Where unaudited organizations with more than $50k in expenses who are following FASB guidelines put conditional contributions in the CDP survey:

- Do not record conditional contributions that have been pledged but not yet received in the CDP.

- Record conditional contributions that have been received but have not yet had their conditions met on the Current Liabilities Not Included Above line of the Balance Sheet section.

What changes might I see in my funder report?This change may result in your organization showing higher liabilities and lower assets than in previous years. Your organization may see lower asset values, as conditional grants not yet received will not longer appear in your Accounts Receivable as pledges. Your organization may see higher liabilities, as advance payments on conditional grants whose conditions have not yet been met will show as liabilities rather than showing as restricted net assets.

How can I explain a shift in assets on my funder reports?If you see a change in your balance sheet because of the FASB update and would like to add a brief explanation that will appear on the funder report, we recommend that you use the Funder Report Narrative on the Balance Sheet page of the CDP survey.

More information on Funder Report Narratives.Example funder report narrative: "Per the FASB update on conditional contributions, there was a $5,000 recategorization from restricted net assets to current liabilities not included above to account for a conditional grant to be used for expenses for a fundraising gala that was postponed due to covid-19. We intend to host the event in 2021."

Additional Resources:

The FASB UpdateArticle from GIA reflecting on how these changes will affect non-profit's financial statements.